Buyers are looking to maximize profitability through achieving administrative efficiencies, bringing together multiple practices in a service area, the development of new income streams, and a reduction in overhead. Many medical practices fail to invest in appropriate management infrastructure and as a result, miss out on growth opportunities, revenue enhancement, and cost saving initiatives, as physicians are oftentimes too busy to focus on these areas. Prepare for retirement 5 to 7 years in advance. Keep in mind that many buyers will want you to stay with the practice for 2-5 years post-acquisition.

Build a Formidable Practice

You must build the practice into a bankable, scalable, sustainable business before you sell. While small practices are sold, they usually get attention from medical practices or hospitals at a low price point because value is in the patient base or referral physicians, not market dominance. You maximize your value by selling a practice that delivers clinical excellence in a cost-effective manner. Your focus shifts from making a living to demonstrating a return on investment for a buyer. You have built the practice by delivering what patients want and need. Now it is time to shape that practice to emulate what buyers and investors want.

Combine to Grow

One strategy that can produce a tremendous financial upside is a combine-to-grow strategic model. Simply pursue a strategy that combines several practices through merger or acquisition, then sell the larger entity for a premium price. Consolidation is driven by the complexity, turmoil and risk of practicing medicine today. The new combined practice provides management, billing / collections, EMR, group purchasing, accounts payable and HR functions so that their providers can grow the clinical side of the practice. Take advantage of multiple locations to grow revenue and your geographic footprint. The more profitable locations you have, the more that value grows.

Develop An OBL

As practice reimbursement continues to remain stagnant or decline, many vascular practices are considering their options to increase revenues. The growth of Office-Based Labs (OBLs) seems to be a logical transition for outpatient endovascular care. While many surgical procedures were once performed solely in a hospital outpatient facility or ambulatory surgical center setting, advances in equipment and endovascular techniques have made it possible to perform complex procedures in the office setting, safely and cost-effectively.

Office-based surgery is any surgical procedure performed by a licensed physician in the office setting. Place of service code 11 (“non-facility”) is used and global billing applies, which means higher reimbursement because payment is combined for professional and technical components of procedures. Since almost all peripheral diagnostic and interventional procedures involving angioplasty, stent, atherectomy, and thrombectomy can now be performed in an office-based facility, this could be an attractive option to capture more revenue. Additionally, office procedures offer improved convenience, comfort and access to patients.

Take A Look At Your Financials

Begin to maximize value at least a year in advance. There may be loans on the books, departments that are overstaffed or other unnecessary expenses that impair profitability. Since purchase prices are based on a multiple of earnings, sellers need to make adjustments 12 to 18 months in advance to increase profitability.

Practice Valuation

Practice valuation models have changed over the years. Practice values used to be referred to as a percentage of collections, but today’s most common reference point is a multiple of earnings before interest, taxes, depreciation, and amortization (EBITDA). Traditionally, a solo physician thought of earnings as the total revenue from the practice in a given year. The reality, however, is that a portion of the revenue is compensation for the physician providing clinical care, and a portion represents profit generated from the practice. Historically, valuations were largely considered the total earnings of the owner, whereas buyers / investors focus on the profits of the practice as a basis for valuation. Further, buyers consider the actual cash flow of the practice on a debt-free basis as the best predictor of their return on investment. This has led to the focus on EBITDA as a measure of a practice’s performance.

What is the right EBITDA multiple?

There is no easy answer to that question because the EBITDA multiple is meant to assess the opportunity of the acquisition and its relative riskiness, as well as provide a reasonable rate of return for the buyer / investor. There are many factors that influence multiples, including location(s), clinical services offered, clinical and administrative staff, stable or growing revenue stream, payer mix, condition of the facility, patient demographics, PCP referral base, and historical profitability.

Although having a pipeline for future growth is important, the most significant influence on the multiple is historical growth. It is also important to recognize that the higher multiples are applied to those practices that have a qualified management team in place to support continued growth and ensure replicable earnings.

The valuation of a practice involves forecasting the performance of the business, in addition to making adjustments for owner compensation, nonrecurring expenses, and discretionary expenses. The purpose of forecasting is to help a prospective buyer / investor see the true investment opportunity, which may not be reflected in the historical financial performance. For example, if the practice acquired a practice partway through a given year, the historical financials only reflect that partial additional impact on revenue and EBITDA. The EBITDA adjustment in this example is to show the prospective buyer / investor the impact of the acquisition for a full year.

Steps To Follow

- The acquisition process usually begins with an NDA (non-disclosure agreement) signed between the parties. The NDA is designed to simply have the parties keep all information and documentation exchanged as confidential.

- Next is the non-binding Letter of Intent (LOI). The LOI guides the transaction.

- Due diligence is the period of time after an LOI is signed (60-90 days), during which time the buyer will thoroughly look through all areas of the practice, as well as the financials to identify any issues. Both parties should be forthcoming during due diligence to avoid any last-minute surprises.

Selling a medical practice is an exciting time, but not one where you want surprises. However, due diligence and very thoughtful deliberation are necessary and crucial to see if it is the right situation for your practice. Your advisors will help reduce the risk to you while maximizing the value you receive.

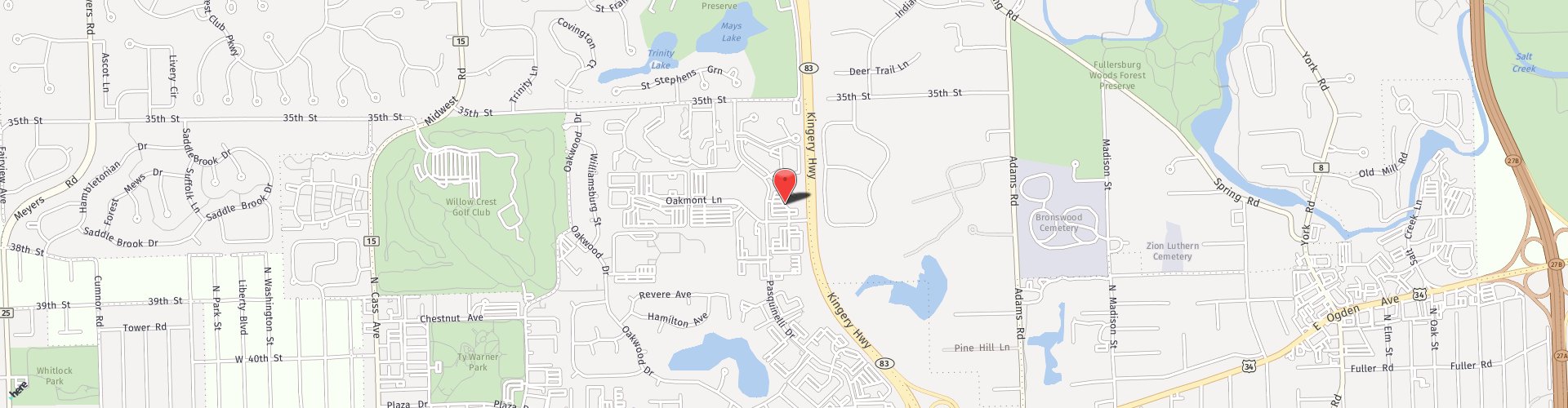

Hi David . I own a vein clinic in highland /Indiana , 8 minutes drive from state line with IL. (Vein Care Center),since May 2003 .I am interested in selling my practice and being employed by the buyer until I retire within 1-3 years . My question to you :

Is evaluation of practice a part of what you offer and wether helping in the process is also a part of what you do. I appreciate your response.

Hello Dr. Haddadin,

Thank you so much for your question. I have reached out via email with some information for you. Please feel free to contact me at [email protected] or at (630) 455-4528. I look forward to speaking with you.

I’m interested in selling my three practices lancaster Lebanon and reading pa. I e been doing veins full time for years. I’m 63 an getting ready to retire in next couple years. I need guidance in selling. Thank you Glenn kline D.O.