Today more than ever, the plea from physicians that I work with around the country is, “Help us manage and/or reduce our overhead!” To maintain their incomes in today’s healthcare environment, physicians have two options:

- Increase EVLA and Sclerotherapy revenues; or

- Decrease expenses.

It is sad but true, that payor reimbursements show little hope of increasing to offset rising administrative and clinical expenses necessary to run your vein practice. Therefore, physicians need to focus carefully on overhead. As a practice management advisor to medical practices nationally for over 25+ years, I would like to share my thoughts with the readers of VEIN magazine. While many physicians believe that there is very little fat left to trim within their medical practices, savvy consultants can reduce costs through inventive, resourceful means, resulting in higher profits for the practice and loyalty and appreciation from the physicians.

Cutting costs, however, is no easy task. Rarely does our firm find practices with staff taking leisurely breaks or standing around with nothing to do. Most practices have a lean workforce with few obvious expenses to cut. The step-by-step process outlined in this synopsis will help you plan your strategy for evaluating your overhead and improving your practice’s bottom line.

Review Internal Controls

Financial controls are crucial for reliable data. The practice must know how much money is flowing out of the business in order to control expenditures. While most people think of internal controls as a means to safeguard against fraud, they actually are the key to making sound management decisions. Proper internal controls help prevent and detect errors. Medical practices today are fast-paced, complex businesses. Mistakes happen. A good system of checks and balances helps minimize inadvertent mistakes. In addition, the mere presence of formal control procedures encourages adherence to policies. The staff can sense when an office environment emanates a lack of accountability and controls. The end result is that sloppiness proliferates and financial data becomes useless.

Internal controls require segregation of duties and a system of checks and balances. The larger the practice, the easier it is to segregate duties and install a system of checks and balances. The larger the practice, the easier it is to segregate key financial duties. Even in a small group practice, a minimum amount of segregation is possible. Physician involvement (or at least the appearance thereof) is an effective enforcement method. If you’re not sure how strong the practice’s controls are, perform an internal control study. Based on results, you can determine how much you can rely on the practice’s data and adjust your analysis accordingly.

Perform Due Diligence

Determine where the practice stands in relation to its peers. It’s very difficult to assess the appropriateness of expenses if you don’t have some benchmark data to measure against. Gather the necessary reports – financial statements, month-end and year-end management reports, billing reports, and budgets. Study the trends from year to year and month to month. Compare your data to specialty-specific industry statistics, first making sure that you group your data the same way they do. Analyze and explain variances between your practice and the associated benchmarks. For example, look at ratios of expenses to revenue, amounts per-physician or per-provider, and full time equivalents (FTEs) per-physician or per-provider.

Carefully Review Your Largest Expenses

Focus first on overhead items that represent the largest individual expenses. For most vein practices, clinical supplies, marketing costs and staff salaries are the largest expenses. Be sure that current staffing levels are appropriate in relation to the number of providers in the practice. Whenever possible, allocate personnel to broad groupings such as front office, clinical staff, and back office or even individual job categories. Consider the practice’s overall productivity (volume) in your analysis of staffing. I recently performed a staffing analysis for a client who insisted he was overstaffed. When we compared his provider-to-staff ratio to similar practices, his analysis appeared to be correct. His annual charges and receipts, however, were almost double that of similar practices, thus creating more work and higher staffing requirements.

If you believe your practice is overstaffed, take the time to construct creative ways to reorganize. Rather than eliminate personnel, investigate to see if existing staff can be used to make the providers more productive. Look for efficiencies and delegate tasks to the lowest wage possible. Once you have examined the number and mix of the staff, look at salaries and turnover. Make sure that salaries are competitive within the practice’s geographic area. Paying a fair salary results in a satisfied, motivated staff, whose contributions are productive and profitable. Recruitment fees, training costs, and loss of productivity associated with turnover is much more costly than giving raises and bonuses to a highly qualified staff. Having said this, avoid the “salary creep” that results from giving automatic cost-of-living raises year after year. Each position within your practice should have an associated wage scale that is competitive within your service area but not above industry standards.

Many practices lose significant dollars each year by not adequately accounting for PTO (paid time off) time. Make sure all PTO policies are documented, communicated to staff, that planned leave is approved in advance, and that a designated person tracks employee PTO accruals. Be sure that overtime is approved in advance, monitored, and whenever possible, avoided. We often see practices that spend $60,000 or more in annual overtime expenses. In some areas, this equates to two additional full time employees (FTE), including benefits. In this scenario, simply hiring one FTE and closely monitoring overtime would provide significant savings. Besides the obvious savings of any unwarranted overtime, it is cheaper to hire full time employees and pay their salary plus benefits, than pay overtime at time and a half. In addition, excessive overtime can cause otherwise good staff to burn out and become inefficient.

In a tight job market, alternative staffing such as outsourcing and job sharing is often beneficial. Transcription, practice management, payroll processing, benefits administration, bookkeeping, and billing / collections all lend themselves well to outsourcing. Job sharing offers flexible work schedules and often eliminates the cost of fringe benefits. Practices should avoid having too many part-timers, however, as inefficiencies and redundant training costs occur. Finally, cross-training for every position should be required to offer flexibility when the staff is on leave and to reduce training costs when turnover occurs.

Since fringe benefits such as health insurance, can be a larger part of support staff costs, the practice should solicit competitive bids every year or two. Alternative benefit options, such as 401(k) and cafeteria plans, are valuable tools for recruiting and retention, with little or no cost to the practice.

In many practices, building and occupancy costs result in the second largest overhead item. Square footage needs should be assessed and rental rates should be negotiated each time a lease is up for renewal. The landlord’s operating costs and Consumer Price Index (CPI) pass-throughs should be audited periodically. Even if a lease is not up for renewal, a professional specializing in tenant representation may be able to renegotiate the rates if the market situation is right. The practice should regularly evaluate its space needs. If there is excess capacity, it should consider sub-leasing, sharing space, or reconfiguring the space to make room for more providers.

Hoard Nickels and Dimes

After you are certain that you have dealt with the big ticket areas, start looking for the small savings. Perform a cost/benefit analysis on ancillary services and evaluate the lease versus buy options for every capital purchase. Examine the cost of medical supplies, office supplies, advertising, repairs, and maintenance contracts. Ask your office manager questions such as, “Do you really need a large ad in the Yellow Pages? How many patients were referred to you by the ad?” You should be encouraged to bid out maintenance and other vendor contracts on an annual basis. Closely monitor invoices from other professional advisors and take advantage of prompt payment discounts. Look to opportunities for group purchasing. Centralizing the practice’s purchasing policies can minimize duplications and waste. Practices should always encourage and reward staff for ideas that lead to cost savings.

Search for Lost Revenue

Lost revenue can occur in many forms. I often sees practices that do not consistently capture all charges, do not accurately code for services performed, fail to resubmit claims that have been denied due to correctable errors or missing information, and allow patient account balances to go uncollected. Amazingly, I still find practices that have not raised their fees in years and are receiving full payment from major carriers – a sure sign that their fees are too low! Other areas of lost revenue include failure to aggressively collect co-pays.

Summary

Once you have completed these five steps, the practice should have developed efficient systems for internal controls; benchmarking production and expenses; reviewing staff levels, salaries and benefits; obtaining competitive bids and looking for other ways of reducing and controlling costs. Don’t allow this to be a one-time effort, insist on continuing diligence. Review the practice’s financial statements and management reports each month to look for discrepancies, unusually high expenses, or other opportunities to save money.

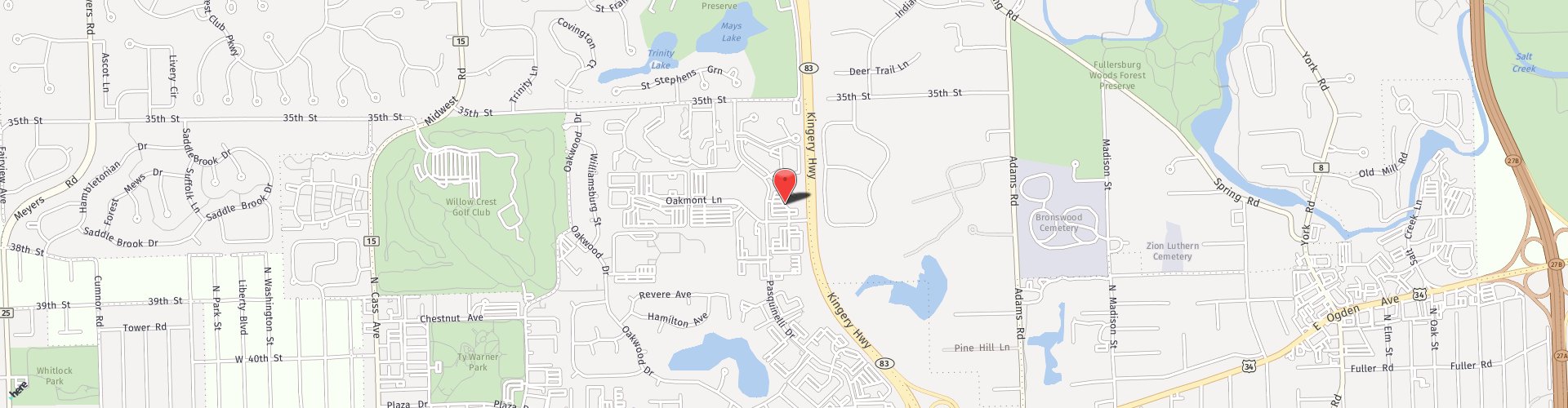

David Schmiege is the president and CEO of Vein Specialists of America Ltd., a practice management consulting and advisory firm. Please direct any questions you may have for Schmiege to 630-789-3636 or e-mail him at [email protected].